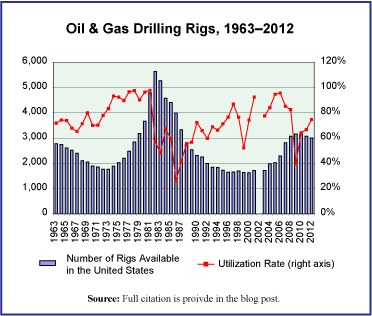

The rising demand for oil on the global scale has been an engine of growth for more than a decade for the oil and gas drilling equipment industry. Since 2005, in the United States alone, 1,538 newly constructed oil drilling rigs were brought into the market valued at approximately $53 billion. We offer a graphic that shows the number of rigs available in the U.S. market annually and the percent of utilization of those rigs for a fifty year period.

Today’s market size is the number of oil drilling rigs available to the market in 2012, of which 94% are land-based drills and 6% are drills for use in offshore applications.

Geographic reference: United States

Year: 2012

Market size: 3,006 oil drilling rigs

Source: “U.S. Rig Census Historical Data, 1955-2012,” National Oilwell VARCO Downhole’s 59th Annual Rig Census, November 2012, page 10, available online here.

Original source: IHS Drilling Data, RigData, ODS-Petrodata, and WorldOil.com

Posted on October 16, 2013