Year: 2020 and 2028

Market size: $7.08 million and $1.03 billion, respectively

3D printers have come a long way since they were invented by Charles W. Hull in the mid-1980s. 3D printing, also known as additive manufacturing, involves laying down material, layer by layer, to form three-dimensional objects. The instructions to do this come from digital files created using computer-aided design or computer-aided manufacturing software. The files can also be created using a 3D scanner. While much of 3D printing is used to create product models and prototypes, final products are also being made, from toys to auto parts to prosthetic devices. And, more recently, houses and other infrastructure. In January 2021, the first neighborhood of 3D printed houses was being built in California. In April 2021, a couple in the Netherlands became Europe’s first tenants of a fully 3D printed house. Venice is home to the first 3D printed concrete footbridge and Amsterdam is home to the first 3D printed steel footbridge.

The advantages of 3D printing in the building sector include high accuracy, increased efficiency, reduced labor cost, and greater speed in construction. Some houses can be built in two or three weeks at a 40% lower cost. 3D printing also allows builders to construct complex building structures that would be difficult or impossible the traditional way. In addition, 3D printing construction is more eco-friendly than traditional building methods. According to the World Green Building Council, the building and construction sector produces 39% of all carbon emissions. However, 3D printing methods can prevent up to 2,000 kg of carbon dioxide from entering the atmosphere per house built. It also produces up to 10 times fewer waste products than traditional building methods.1 Major disadvantages hindering adoption of this technology on a wider scale are the high cost of investment in both equipment and materials,2 lack of skilled labor, limitation of the machinery, and concerns about the intellectual property rights of the structural designs.Two of the most used methods of 3D printing construction are extrusion and powder bonding. Extrusion accounted for a greater than 61% revenue share in 2020. This method is mostly used for on-site construction. It uses traditional construction materials such as geopolymers, concrete, cement, clay, and plaster. Powder bonding is expected to see significant growth through 2028 as demand for faster, simpler, and more accurate methods for creating complex formwork increases.

Concrete had the highest revenue share in 2020, 32%. 3D concrete printing is used as an alternative to traditional concrete construction to reduce cost, labor, and time. Metal is expected to experience substantial growth through 2028. Metal 3D printing is used primarily for designing facade nodes and other connectors. It’s also used for bridge construction.

The construction of commercial, residential, and industrial buildings accounted for more than 73% of revenue in 2020; the other 27% was from infrastructure. The Asia-Pacific region held a 38% revenue share in 2020, the highest in the world. Major companies in this market include COBOD International A/S, Yingchuang Building Technique Co. Ltd., XtreeE, Apis Cor, WASP S.r.l., CyBe Construction, Sika AG, MX3D, Contour Crafting Corp., ICON Technology Inc., and Constructions -3D. Some developers and construction companies are partnering with 3D printing companies to strengthen their market share and increase their offerings. For example, 3Strands, a Kansas City developer, partnered with ICON to build 2- and 3-bedroom homes in Texas. Other companies are focusing on innovative product offerings to attract clients. Yingchuang Building Technique built the first 3D printed bus stop in Jinshan Garden, China. It was made using recycled waste material.

The 3D printing construction sector is a minuscule part of the overall $11.5 trillion global construction market and is expected to still be a tiny part of the overall market in the future, despite anticipated growth of more than 14,500% from 2020 to 2028. But, as the demand for green affordable housing and environmentally-friendly business practices grows and the supply of construction workers shrinks, 3D printing construction may take up an increasingly larger share of the overall construction market.

1 According to Mighty Buildings, a builder of modern 3D printed prefabricated buildings.2 Industrial scale 3D printers used in construction, some measuring 20 feet high, 140 feet wide, and 120 feet long, cost more than half a million dollars. Materials used for these printers cost considerably more than traditional building materials.

Sources: “3D Printing Construction Market Size, Share & Trends Analysis Report by Construction Method (Extrusion, Powder Bonding), by Material Type, by End User (Building, Infrastructure), by Region, and Segment Forecasts, 2021 – 2028,” Grand View Research Report Overview, July 2021 available online here; “3D Printing Construction Market Size Worth $1,034,096.7 Thousand by 2028: Grand View Research, Inc.,” CISION PR Newswire, July 22, 2021 available online here; “Global Construction Market Expected to Reach $16.6 Trillion by 2025, Growing at a CAGR of 7% – ResearchAndMarkets.com,” Business Wire, March 9, 2021 available online here; Rosie Frost, “These 3D Printed Net-Zero Buildings Could Be the ‘Future of Housing’,” euronews.green, April 1, 2021 available online here; Sam Lubell, “3D-Printing Is Speeding Up the Automation of Construction,” Metropolis, February 15, 2021 available online here; Matt Hickman, “World’s First 3D-printed Steel Bridge Debuts in Amsterdam’s Red Light District,” The Architect’s Newspaper, July 21, 2021 available online here; Tony Hoffman, “3D Printing: What You Need to Know,” PC Mag, July 1, 2020 available online here; Daniel Boffey, “Dutch Couple Become Europe’s First Inhabitants of a 3D-printed House,” The Guardian, April 30, 2021 available online here.

Image source: Mebner1, “printer-3d-pressure-3d-printing-1455166,” Pixabay, June 15, 2016 available online here.

Globally the number of cyber security incidents increased 1,637% from 3.4 million incidents in 2009 to more than 59 million incidents in 2015. In the United States the number of data breaches alone increased from 446 in 2007 to 1,579 in 2017. According to Steve Langan, chief executive at Hiscox Insurance, cybercrime cost the global economy more than $450 billion dollars in 2016.

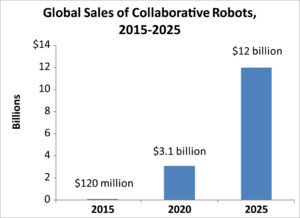

Globally the number of cyber security incidents increased 1,637% from 3.4 million incidents in 2009 to more than 59 million incidents in 2015. In the United States the number of data breaches alone increased from 446 in 2007 to 1,579 in 2017. According to Steve Langan, chief executive at Hiscox Insurance, cybercrime cost the global economy more than $450 billion dollars in 2016. Collaborative robots, or co-bots, are robots that work alongside human workers. Many workers are wary of the increased use of robots in general, fearing the loss of their jobs. M.I.T. and Boston University estimated that up to six people lose their jobs for each robot per 1,000 workers a company adds. Employers, however, cite increased productivity, cost savings, and healthier work environments when robots are used in the workplace. Robots can work in hazardous jobs or do repetitive tasks thereby reducing worker injuries.

Collaborative robots, or co-bots, are robots that work alongside human workers. Many workers are wary of the increased use of robots in general, fearing the loss of their jobs. M.I.T. and Boston University estimated that up to six people lose their jobs for each robot per 1,000 workers a company adds. Employers, however, cite increased productivity, cost savings, and healthier work environments when robots are used in the workplace. Robots can work in hazardous jobs or do repetitive tasks thereby reducing worker injuries. The market for smart wearable healthcare devices is one part of the larger smart wearables market as a whole. The term wearables is used to refer to any electronic device, usually small, that can be worn relatively easily during the normal activities of life. Examples include wristbands such as the Fitbit, smart watches, clip on devices like pedometers and even clothing into which sensors have been sewn.

The market for smart wearable healthcare devices is one part of the larger smart wearables market as a whole. The term wearables is used to refer to any electronic device, usually small, that can be worn relatively easily during the normal activities of life. Examples include wristbands such as the Fitbit, smart watches, clip on devices like pedometers and even clothing into which sensors have been sewn.