Year: 2020 and 2025

Market size: $1.03 billion and $1.10 billion, respectively

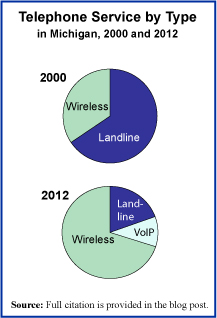

In the United States, March 10th marks National Landline Telephone Day. So, in the spirit of the “holiday,” this week’s post is dedicated to this aging and slowly disappearing technology. Today’s market size shows landline telephone revenues in 2020 and projected for 2025.1 While it may seem to many that almost everyone has “cut the cord” and gotten rid of their landline phones in favor of cell phones, this is far from the case. In 2019, 39.7% of U.S. adults were living in a household with a working landline. Of course, this is considerably less than the 92.7% in 2004. The percentage of adults living in cell phone only households rose from 5.0% in 2004 to 59.2% in 2019.

Despite predictions that landlines would be obsolete by 2020, they are still being used in millions of households and businesses across the U.S. Why? While younger adults may be more comfortable using smartphones, many older adults prefer landlines — a simple phone without all the bells and whistles they may not need, want, or understand how to use. As of June 2019, 11.4% of people 65 years old and older relied on a landline. People who have a lower income may find that keeping a single landline is less expensive than paying for cell phone service. Some people and businesses keep landlines because their security systems rely on them. Older elevators may require landlines for their emergency phones. Some people retain their landline in case of emergencies. Since a landline is linked to a specific address, when someone calls 911 the dispatcher will know exactly where the caller is calling from even if that person cannot communicate. A cell phone’s GPS cannot do that. Landline, corded phones will not become inoperable when there is a power or internet outage as cellular, fiber optic, and VoIP phones can.2 It is for these reasons the National Emergency Number Association recommends people with disabilities and those with medical conditions have a traditional landline phone. Some people keep landlines because they offer better call quality than cell phones. In rural areas where cell phone service is nonexistent or spotty, landlines provide reliable phone service.

With more and more customers “cutting the cord,” maintaining landline phone infrastructure for fewer and fewer customers scattered throughout the U.S. is getting increasingly more expensive for telecommunications companies. In 2017, it was estimated that companies spent $13.5 billion to maintain this infrastructure. While some companies still offer traditional, wired landline services, some companies are charging much higher prices than they did in the past for this service. According to the U.S. Bureau of Labor Statistics, in urban areas, landline service costs rose 26% from July 2010 to July 2020 while cell phone services decreased 23%. Other companies offer customers landline service only if it’s bundled with cell phone, internet, and TV services. Others still only offer fiber optic or VoIP phone service, providing phone service over the same lines that provide customers with internet service. For at least a decade, telecommunications companies have set dates for when they would discontinue all traditional, wired landline services in the United States. In 2017, legislatures in 20 states voted to allow AT&T to discontinue landline service in their states completely. In Illinois alone, this would’ve affected 1.2 million customers. Until reliable cell phone or internet phone service can be obtained in every home and business in the country, any discontinuation of service will have detrimental effects on individuals and businesses. They’ll not only be losing a way to communicate with friends, family, and customers but they’ll also be losing a reliable way to call for help in an emergency.

1 The U.S. Centers for Disease Control considers VoIP phones landline phones.2 In some cases, companies offer battery back-up options for power outages or options to switch internet-based phones to cellular service if there is an internet outage.

Sources: “Landline Phones,” Statista available online here; “March Holidays,” National Today available online here; Felix Richter, “Landline Phones are a Dying Breed,” Statista, June 15, 2020 available online here; Krystal Steinmetz, “Landline Phones Disappearing in These 20 States,” MoneyTalksNews, June 5, 2017 available online here; Robert Channick, “AT&T Ready to Hang Up on Traditional Landline Phone Service in Illinois,” Chicago Tribune, May 4, 2017 available online here; Dennis Peng, “Are Copper Phone Lines Going Away?” Ooma Blog, February 14, 2019 available online here; John R. Quain, “Is It Safe to Get Rid of Your Landline?” AARP, August 25, 2020 available online here; “Why Nearly 46 Percent of Households Still Have Landlines,” New York Post, May 4, 2017 available online here; “Landlines Predicted Obsolete by 2020; ULTATEL Explains What This Means for Businesses,” Markets Insider, July 16, 2018 available online here; “POTS (Plain Old Telephone Service) is Going Away. What’s Your Plan for the Future?” Broad Sky Networks, December 23, 2019 available online here; “Find Home Phone Services,” allconnect available online here.

Image source: Katrin Hauf, “Old Style Telephone,” Unsplash, March 25, 2020 available online here.