Shared micromobility systems are fleets of rentable lightweight one-passenger vehicles used mostly for utilitarian purposes. Riders use a smartphone app to unlock and rent vehicles. In cities where shared micromobility systems exist electric scooters (e-scooters), bicycles, and electric pedal-assisted bicycles (e-bikes) are the primary vehicles in use. When micromobility services were first offered, vehicles were docked. There were dedicated places where the vehicles were to be picked up or dropped off. More recently, companies have implemented a dockless model. Vehicles can be left anywhere or anywhere within a geofenced area as long as they do not impede pedestrian and motor vehicle traffic.

While some cities have embraced micromobility services as part of their overall transportation plan others have banned such services outright. For those that have allowed e-scooters and bicycle sharing systems in their city, these services are seen as a way to reduce traffic congestion and vehicle emissions. More than half the car trips in the United States are 5 miles or less. According to a study by the Portland Bureau of Transportation, had e-scooters not been available in Portland, Oregon, 34% of residents and 48% of tourists who have used this mode of transportation said that they would’ve taken a car, taxi or ride-haling service to their destination. For those who do not have a car and who may not live near public transportation, shared micromobility services allow them to get to and from their home, shopping and workplace easier by using these modes of transportation as a way to get to and from public transportation stops. But, these services may also be a replacement for public transportation for some riders. The average trip lengths for rail, bus and streetcar transportation are 4.9, 3.8 and 2.0 miles, respectively.1 Distances that can easily be traversed with a bicycle or e-scooter. And, while lower ridership on public transportation is a concern for some cities that have banned or strictly regulated shared micromobility solutions, especially e-scooters, the bigger concern is with public safety.2 Where bike lanes are unavailable, riders are more likely to share sidewalks with pedestrians. This presents a possible danger for pedestrians as well as e-scooter riders as these vehicles can travel up to 15 miles per hour. The danger for the e-scooter rider or e-bike rider if sharing the road with cars and trucks is even greater. Injuries due to inexperienced riders, uneven riding surfaces, nighttime use, and malfunctioning equipment are also concerning to city administrators. According to Consumer Reports, from the fall of 2017 to June 2019, there were 1,500 injuries3 to riders of rentable e-scooters and 8 deaths.

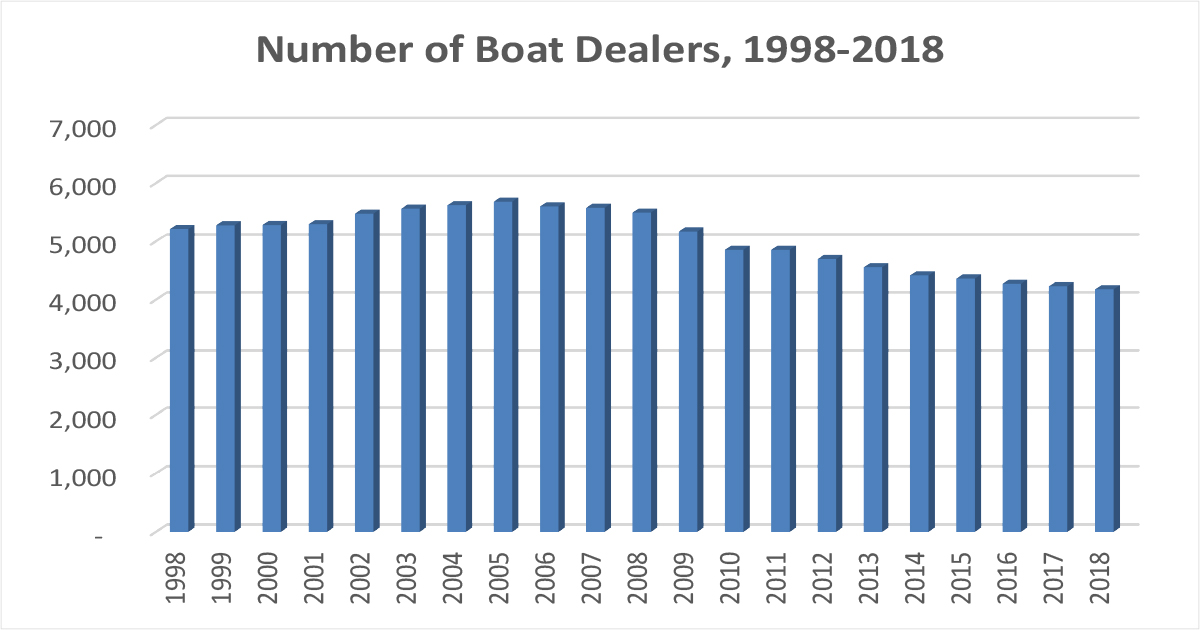

Today’s market size shows the number of trips taken on shared micromobility vehicles in 2010, 2014 and 2018 in the United States. From 2017 to 2018 the total number of trips taken more than doubled from 35 million in 2017 to 84 million in 2018. Nearly all of this increase was due to e-scooter use. In fact, the number of e-scooter trips surpassed the number of station-based bike-share trips that year. Trips taken on shared e-scooters totaled 38.5 million, followed by station-based shared bicycles (36.5 million), e-bikes (6.5 million) and dockless shared bicycles (3 million). By the end of 2018, there were 85,000 e-scooters in use in 100 cities around the U.S. Station-based bikes numbered 57,000. Meanwhile, dockless bicycle-sharing all but disappeared. Seattle was the only city to still offer this service at the end of 2018. Despite the popularity of e-scooters overall, in 2019 both Lyft and Uber (JUMP brand) took their e-scooters off the streets of several cities due to lack of profitability and tightening regulations. Lyft reported they would refocus their e-scooter sharing operations in markets where population density is the greatest. Other leading e-scooter rental companies operating in the United States include Lime, Bird, Skip, Spin, and Scoot. Leading station-based bike-share systems by ridership include Citi Bike NYC (New York, NY), Capital Bike Share (Washington, D.C.), Divvy (Chicago, Ilinois), Ford GoBike (Bay Area, California), Bluebikes (Greater Boston area, Massachusetts), and Biki (Honolulu, Hawaii). In 2018, 84% of all station-based bike-share rides in the United States were concentrated in these 6 cities. That same year, 40% of all e-scooter rides were concentrated in Los Angeles, California; San Diego, California; and Austin, Texas.

1 Includes both heavy rail and light rail but not commuter rail.

2 Other concerns involve the dockless e-scooters and bikes being left on city sidewalks impeding pedestrians and the disabled. Some cities have imposed restrictions on the use of these vehicles in order to address the concerns.

3 Injuries in which the rider went to the hospital. Data from 110 hospitals in 47 cities.

Geographic reference: United States

Year: 2010, 2014 and 2018

Market size: 0.3 million, 18 million and 84 million, respectively

Sources: George Paul, “Lyft Will End E-Scooter Operations in 6 Cities and Lay Off Around 20 Staff Members,”

Business Insider, November 18, 2019 available online

here; Rasheq Zarif, Derek Pankratz, and Ben Kelman, “Small is Beautiful,”

Deloitte Insights, April 15, 2019 available online

here; “Micromobility,”

Wikipedia, December 17, 2019 available online

here; “Shared Micromobility in the U.S.: 2018,” National Association of City Transportation Officials, April 2019 available online

here; Greg Gardner, “Nashville Mayor Proposed E-Scooter Ban; Then Council Changed the Rules,”

Forbes, September 16, 2019 available online

here;

2019 Public Transportation Factbook, American Public Transportation Association, April 2019 available online

here;

2018 E-Scooter Findings Report, Portland Bureau of Transportation, January 15, 2019 available online

here; Megan Rose Dickey, “JUMP Pulled Its Bikes From a Number of Markets in the Last Few Months,”

Tech Crunch, September 13, 2019 available online

here; Megan Rose Dickey, “Lyft is Ceasing Scooter Operations in Six Cities and Laying Off 20 Employees,”

Tech Crunch, November 14, 2019 available online

here; Adeyemi Ajao, “Electric Scooters and Micromobility: Here’s Everything You Need to Know,”

Forbes, February 1, 2019 available online

here.

Original source: National Association of City Transportation Officials.

Image source: Christian Bueltemann, “e-scooter-escooter-electric-scooter-4496668,”

Pixabay, October 2019 available online

here. Use of image does not constitute an endorsement.