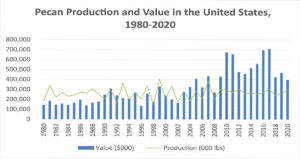

Year: 1980, 1990, 2000, 2010 and 2020

Market size: $143.3 million, $247.6 million, $238.8 million, $674.8 million and $398.8 million, respectively

June 24th is National Pralines Day in the United States. A praline is a confection made of nuts and a sugary, caramelized coating. While the exact inspiration behind pralines is in doubt, what is certain is that it was named after a French sugar industrialist and diplomat from the early 17th century, César, duc de Choiseul, comte du Plessio-Praslin, whose personal chef, Clement Lassagne, invented the sugary treat. It’s believed that pralines were brought to the United States by the Ursuline nuns who came to New Orleans in 1727. The Ursuline nuns were in charge of young women who were sent from France at the request of the colonial governor of Louisiana and founder of New Orleans, Jean-Baptiste Le Moyne de Bienville, in order to marry colonists living in New Orleans. As part of their education, the women were taught “the art of praline making.”1 Pralines were originally made with almonds, but almonds were in short supply in Louisiana so cooks substituted pecans whose trees are native to the area. In the mid-to-late 19th century Pralinières were women who sold pralines on the streets of the French Quarter. This provided a source of income, without any strings attached, for free women of color.

Today’s market size shows the value of utilized pecan production in the United States from 1980 to 2020 in 10-year intervals. As the graph above shows, since 1980, production has varied widely from year to year, with the lowest and highest production falling in back-to-back years: 146.4 million pounds in 1998 and 406.1 million pounds in 1999. Since 2009, production has stabilized between about 245 million pounds and 302 million pounds. The value of production also varied during this time period but trended steadily upward until 2010 when the value of pecans reached its highest level in at least the past 30 years, a 57% increase from 2019. Over the next three years, the value of pecans dropped, with the biggest drop coming between 2011 and 2012.

From 2013 to 2017, the value of utilized production trended upward again, reaching a high of $709.4 million. 2017 was also the year with the highest utilized production since 2007 at almost 304.9 million pounds. Since then, the value has trended downward. From 2017 to 2018, utilized production dropped 27%, but has been climbing steadily ever since, reaching 302.4 million pounds in 2020. Production value, on the other hand, dropped 43.8% over this time period.

The fall in value from 2018 to 2020 from the 2017 high may be attributed, in part, to the trade war between China and the United States. Before the trade war, China was the largest export market for U.S. grown pecans. Chinese demand for pecans influenced the type of pecans growers produced, varieties of oversized nuts with high yields. Since the trade war began, Chinese demand for pecans grown in the United States dropped considerably, with prices falling in parallel. But consumer demand did not abate. Many of China’s pecan buyers have since turned to Mexico. Mexico’s exports to China increased by more than 3,000% in 2018 from a year earlier. Mexican pecans exported to China carry a 7% tariff. A tariff of 47% is applied to pecans from the United States.

Meanwhile, Mexican pecan growers have expanded their market into the U.S. and more U.S. buyers are buying. The United States is the largest export market for Mexican pecans. Because of lower production costs, pecans grown in Mexico are less expensive than pecans grown in the United States.2 According to Lanair Worsham, owner of Worsham Farms in Camilla, Georgia, and a member of the Georgia Pecan Commission, “If you eat a pecan product here in America, there’s a 75% chance that it’s Mexican.” Pecans from Mexico can be found in pies and other products on grocery store shelves and on restaurant menus.Several officials, including the Georgia Agricultural Commissioner, lobbied during negotiations on the U.S.-Mexico-Canada Agreement to include a provision to make it easier for U.S. farmers to file anti-dumping and countervailing claims against exporters, but the provision was ultimately left out of the agreement. In 2020 some growers were worried about the challenges facing the U.S. pecan industry, especially in the southeast where growers were still recovering from hurricanes. Will the industry remain sustainable for the foreseeable future?

Mexico is the largest producer of pecans in the world, claiming 48% of the global supply. The United States follows with 46%. South Africa (4%) and Australia (1%) also produce pecans for the world market. In the United States, 15 states produce pecans commercially: Alabama, Arkansas, Arizona, California, Florida, Georgia, Kansas, Louisiana, Missouri, Mississippi, North Carolina, New Mexico, Oklahoma, South Carolina, and Texas. Georgia produced the most in 2020, 142 million pounds, followed by New Mexico (77 million) and Texas (45.4 million). There are more than 1,000 varieties of pecans, many named after Native American tribes. Only 20 varieties are produced commercially, the most popular being Cape Fear, Desirable, Moreland, Stuart, and Natives. Natives are wild seedlings. Wild varieties tend to have thicker shells and less nutmeat. Improved varieties have thinner shells that can be broken by hand and have more nutmeat. Improved varieties are preferred for commercial use.

1 Source: “History of the Praline,” Southern Candymakers available online here.2 Production costs in Mexico are approximately $860 per acre. In the southeastern United States, $1,500 per acre.

Sources: “Tree Nuts,” Fruit and Tree Nuts Yearbook Tables, Economic Research Service, United States Department of Agriculture, October 29, 2020 available online here; “History of the Praline,” Southern Candymakers available online here; “Pecan Production,” National Agricultural Statistical Service, Agricultural Statistics Board, United States Department of Agriculture, January 21, 2021 available online here; “What are the Differences in Pecan Varieties?” Royalty Pecan Farms, December 1, 2014 available online here; Matthew Bailey, “Pecan Prices and Trade Tensions Between China and the US,” Pecan Report, July 23, 2020 available online here; Clint Thompson, “Georgia Pecan Grower: Industry on Brink of Collapse,” VSCNews, November 20, 2020 available online here; “3000% Increase in Mexican Pecan Exports to China,” Produce Report, August 12, 2019 available online here; Bill Tomson, “Georgia’s Pecan and Blueberry Farmers Plead for Protection from Mexico,” Agri-Pulse, August 19, 2020 available online here; Clint Thompson, “Southeast Pecan Industry Continues to Face Challenges,” VSCNews, February 14, 2020 available online here; “History of Pecans,” U.S. Pecan Growers Council available online here; “How Pecans are Grown,” U.S. Pecan Growers Council available online here; “Jean-Baptiste Le Moyne de Bienville,” Encyclopedia Britannica, March 2, 2021 available online here.

Image source: Graph was created in-house from the data in “Tree Nuts,” Fruit and Tree Nuts Yearbook Tables, October 29, 2020 available online here and “Pecan Production,” National Agricultural Statistical Service, Agricultural Statistics Board, United States Department of Agriculture, January 21, 2021 available online here.