Traditionally consumers who wanted to purchase personal luxury goods shopped at specialty boutiques or high-end department stores such as Nordstroms, Bergdorf Goodman, or Saks Fifth Avenue. But, just as other brick-and-mortar retail establishments have been affected negatively by online retailers, so too have personal luxury goods retailers. Several online sites such as Net-a-Porter offer multiple brands of high-end merchandise for sale, free shipping and the convenience of shopping from home. Overall, in-store traffic decreased by 30% from 2012 to 2018. Still, according to EY Advisory, although more than 70% of purchases are influenced by online channels, nearly 90% of purchases are made in store.

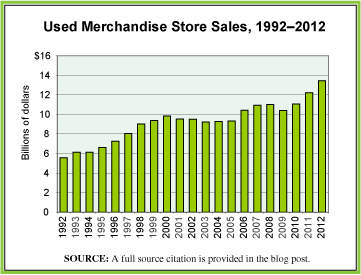

Increasingly, many shoppers in their 20s through 40s who can afford high-end merchandise do not want to pay full price for their purchases. In addition, while many Millennials and Generation Z consumers want to be seen in new styles often, they are also concerned about sustainability. They see clothing resale and reuse as a way to conserve resources while also satisfying their want of a new wardrobe. Overall, 26% of luxury shoppers also buy secondhand. While wealthy consumers are unlikely to shop at places such as Goodwill or other thrift stores, they are shopping online at sites such as Fashionphile and TheRealReal which allow consumers to buy, sell and consign used luxury clothing and accessories and at sites such as Rent the Runway which allows consumers to rent high-end clothing for a monthly fee. Millennial and Generation Z consumers made a third of luxury purchases worldwide in 2018 according to Bain & Co. Purchases made by consumers in these two generations combined contributed to nearly all of the growth in the luxury goods sector in 2018.

Some luxury brands such as Gucci and Louis Vuitton have been opening boutique stores and expanding their website offerings in order to control their exclusivity while at the same time their merchandise is discounted at resale sites. Some luxury retailers are focusing on experiences and services to compete with online retail, resale, and rental sites by offering customers champagne and hors d’oeurves while they shop, having cafés and beverage bars in store, and hiring style advisors to help customers. Nordstrom partnered with Rent the Runway to offer customers the ability to drop off their Rent the Runway fashion items at their store. After learning that half their customers also buy or sell used merchandise, Neiman Marcus invested in a minority share of Fashionphile, however, they do not plan to sell secondhand merchandise in their stores or on their website.3 They may want to rethink that strategy, however. In ThredUp’s 2019 Resale Report, GlobalData, a retail analytics firm, found that 33% of consumers would buy more from luxury retailers if they offered secondhand clothing.

1 For the projected 2025 data, the source mentions the “luxury goods market.” The article in which this appears reports only on personal luxury goods, therefore, our editors assumed that this figure was for personal luxury goods only.

2 The source reports sales figures in euros. Our editors used the December 31, 2018 conversion rate of 1 Euro = 1.1466 U.S. dollars given on the Market Insider website here to convert the sales figures to U.S. dollars. Rankings do not include cosmetics companies. If they did the following companies would be in the top 10: L’Oréal ($30.84 billion), Estée Lauder ($13.99 billion) and Beiersdorf ($8.26 billion). Cosmetics sales include products at all price points.

3 Through the partnership with Fashionphile, Neiman Marcus has designated a few of their stores as drop-off points for customers who want to sell their merchandise on Fashionphile. Sellers receive an immediate quote from Fashionphile for their merchandise and immediate payment if they choose to sell. Neiman Marcus is hoping that customers will then want to use that payment to buy merchandise in their stores.

Note: Any mention of brands or companies in this post does not constitute an endorsement.

Geographic reference: World

Year: 2018 and 2025

Market size: $286.53 billion and $445 billion, respectively

Sources: Anne D’Innocenzio, “Luxury Stores Adapt to Changing Shoppers,” The Denver Post, December 29, 2019, pp. 1K, 6K; Florine Eppe Beauloye, “The 15 Most Popular Luxury Brands Online in 2019,” Luxe Digital, April 20, 2019 available online here; “Tailoring the Luxury Experience: The Luxury and Cosmetics Financial Factbook 2019 Edition,” EY Advisory S.p.A., 2019 available online here; ThredUp 2019 Resale Report, March 2019 available online here; Tom Ryan, “Are Secondhand Sales the Right Branding Move for Neiman Marcus?” RetailWire, April 23, 2019 available online here.

Original source: Bain & Co.

Image source: FranckinJapan, “bag-luxury-accessories-japan-ginza-2060110,” Pixabay, February 13, 2017 available online here. Use of image does not constitute an endorsement.

Did you buy a new TV to watch March Madness? Purchase the latest mobile phone or tablet? Have you bought a new home? If you have, you were probably offered an extended warranty on your purchases.

Did you buy a new TV to watch March Madness? Purchase the latest mobile phone or tablet? Have you bought a new home? If you have, you were probably offered an extended warranty on your purchases.