Year: 2019 and 2027

Market size: $957.8 billion and $1.4 trillion, respectively

Metal recycling is a multibillion-dollar enterprise that will soon become a trillion-dollar industry. Today’s market size shows total global revenues for metal recycling in 2019 and projected for 2027. Society’s focus on conservation of resources and reducing greenhouse gas emissions along with increasing demand for metals are fueling growth in this industry.

By using recycled metal for their finished products, manufacturers can reduce their production costs. Recycling metal is less costly than mining ore and refining it into usable metals. Since the extraction and refining have already been done, the recycled metal just needs to be melted down into usable shapes, eliminating some of the more expensive and energy-intensive steps in the process. Recycling steel uses 74% less energy than creating it from raw materials.

Steel is the world’s most recycled material, with 650 million tons recycled every year. By volume, steel accounted for 79% of recycled metal demand worldwide in 2019. Steel can be infinitely recycled without loss of quality and can be easily separated from other types of metal scrap during the recycling process using large industrial magnets. Despite the large amount of steel that’s recycled, there isn’t enough scrap available to meet the demand for steel products. On average new steel products contain about 37% recycled steel.

China is the largest steel producer in the world, producing more than 996 million tons in 2019, or about 53% of global production. Of that, 215 million tons were sourced from scrap recycling, the most in the world. That year, the United States ranked third in steel production, behind the European Union. It produced 87.9 million tons of steel, using 60.7 million tons of steel scrap.

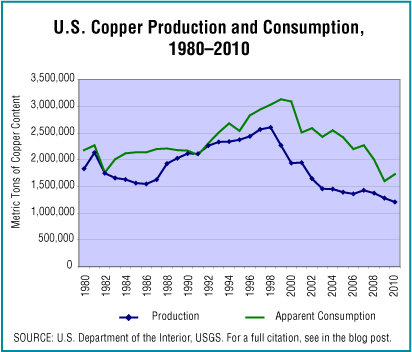

While aluminum and copper make up a small fraction of the metals recycled by volume, recycling rates for both are quite high. The global recycling rate for aluminum is 76%, with 30 million tons being recycled yearly. Three-quarters of the 1.5 billion tons of aluminum ever produced is in use currently. Only about 12% of the 5.8 trillion pounds in the world’s known copper reserves have been mined, but almost all of it is still in circulation. Each year about 8.5 million tons of copper are recovered from scrap.1 In the United States, about 72% of copper used by copper and brass mills, excluding wire production which uses newly refined copper, comes from recycled copper. In Europe, 50% of the copper consumed is sourced from recycled material.By industry, the construction sector held a greater than 46% share by volume in 2019, followed by the automotive sector with a 25% share. Although there was decreased demand for metal in several industries including the construction and automotive sectors in much of 2020 due to the coronavirus pandemic, demand is expected to recover in 2021 and beyond as restrictions ease once vaccination becomes widespread. In fact, by late November 2020 in the United States overseas demand for recycled ferrous metals increased substantially due to governments investing in steel-intensive infrastructure projects. However, the supply of scrap metal has remained below pre-pandemic levels due to seasonal factors and public health restrictions, causing prices to rise.

The Asia-Pacific region is the largest producer of metals worldwide. With its well-established recycling industry, it accounted for more than 67% of global recycled metal revenue. This region is expected to be the fastest-growing market for metal recycling at least through 2027. Rapid urbanization, a need for proper waste management, and a growing manufacturing sector in India, China, Vietnam, Thailand, Myanmar, and Indonesia are expected to increase demand. Europe produces less metal than the Asia-Pacific region, however, its rate of recycled metal usage is higher in comparison to its virgin metal usage. Strict government regulation of energy usage along with an emphasis on the circular economy is expected to lead to increased demand for recycled metal in this region. Several leading metal recyclers maintain a presence in these two regions and in the United States including European Metal Recycling, CMC, Utah Metal Works, GFG Alliance, Norsk Hydro ASA, Kimmel Scrap Iron & Metal Co. Inc., Schnitzer Steel Industries Inc., Novelis Inc., Tata Steel Ltd., and Sims Metal Management Ltd. Tata Steel started its first recycling plant in Haryana, India in June 2019 to gain an early advantage in the Indian market.

1 In comparison, in 2019, 20 million metric tons of copper were mined worldwide.Sources: “Metal Recycling Market Size, Share & Trends Analysis Report by Product (Aluminum, Steel, Copper), by Application (Construction, Automotive, Consumer Goods), by Region, and Segment Forecasts, 2020 – 2027,” Grand View Research Report Summary, July 2020 available online here; “Metal Recycling Market Size Worth $1.4 Trillion by 2027 | CAGR 4.9%: Grand View Research, Inc.,” CISION PR Newswire, January 21, 2021 available online here; “The Environmental and Financial Benefits of Recycling Metal,” Greener Ideal, April 6, 2020 available online here; “How Recycling Your Metal Can Benefit the Economy,” Taroni Metal Recycling available online here; “Steel Recycling,” World Steel Association available online here; “Steel: The Most Recycled Material in the World,” Napa Recycling and Waste Services available online here; World Steel Recycling in Figures 2015-2019, 11th Edition, Bureau of International Recycling, Ferrous Division, 2020 available online here; M. Garside, “Copper – Statistics & Facts,” Statista, December 4, 2020 available online here; “Copper Recycling,” International Copper Association, Copper Alliance available online here; “Europe Leading the World in Copper Recycling,” Energy Industry Review, August 7, 2018 available online here; “Copper – The World’s Most Reusable Resource,” Copper Development Association Inc. available online here; Brian Taylor, “Ferrous Market Booms Its Way Into 2021,” Recycling Today, December 11, 2020 available online here.

Image source: Alexas_Fotos, “copper-scrap-metal-scrap-disposal-1504098,” PIxabay, July 8, 2016 available online here.