Year: 2015 and 2020

Market size: based on market capitalization — $3.902 billion and $83.341 billion, respectively

What are SPACs? The acronym stands for special-purpose acquisition companies and they are what is also known in the investment world as “blank check” companies or shell companies listed on the stock exchange with the sole purpose of acquiring private companies wishing to go public. A SPAC provides an investment vehicle for a group of investors (and/or private equity firms) and can provide a private company that merges with it a means of going public without having to go through an initial public offering (IPO) process.

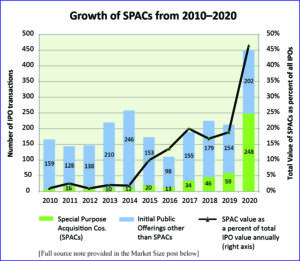

While SPACs have existed since 1993—when the first one was created by the investment bank GKN Securities as a means of skirting the then prohibition to blank check companies on the U.S. Stock Exchange—they have only recently risen to prominence with blue-chip investors and become fashionable investment vehicles. Worth noting, the first SPAC listed in Europe, on the Euronext Amsterdam exchange, was Pan-European Hotel Acquisition Company N.V. in 2007.As the chart above shows, SPACs grew from representing 1 percent of the value of all U.S. IPOs in 2010 to representing nearly half (46.5%) in 2020, and in terms of the number of transactions, SPACs exceeded half in 2020, reaching 55 percent of all new entrants to the U.S. Stock Exchange. More than $80 billion were invested in SPACs in 2020 compared with $13.6 billion the year before. During the first two months of 2021 alone, another $77 billion came into the market through the formation of new SPACs.

All this activity has drawn attention. Short sellers, who bet against a stock’s performance, began in 2021 to target SPACs more heavily. This combined with anticipated increased scrutiny of SPACs by the incoming Biden Administration’s new Securities and Exchange Commission (SEC) Chairman, Gary Gensler suggests that the recent surge in the SPAC market will cool. But, as of the middle of March money is still pouring into SPACs every day, to the tune of millions of dollars a day, something easily monitored at this Stock Market MBA website.Sources: Mike Bellin, IPO Services Co-Leader, PwC US, “Why Companies are Joining the SPAC Boom,” PwC United States, published on September 22, 2020 and available online here; Matt Wirz and Juliet Chung, “Short Sellers Target SPACs,” The Wall Street Journal, March 15, 2021, page 1.

Image source: Graph was produced in-house with data keyed from the website of SPAC Investments Ltd. on March 15, 2021 available online here.