From a work titled

From a work titled

Market Share Reporter—Trends Over Time

that we produced for GALE Cengage Learning as an extension of the popular annual market share compilation that we produce for this publisher annually.

This sample is from pages 247-271.

DRUG STORES

INDUSTRY CODES: NAICS 44611; SIC 5912

DEFINITIONS

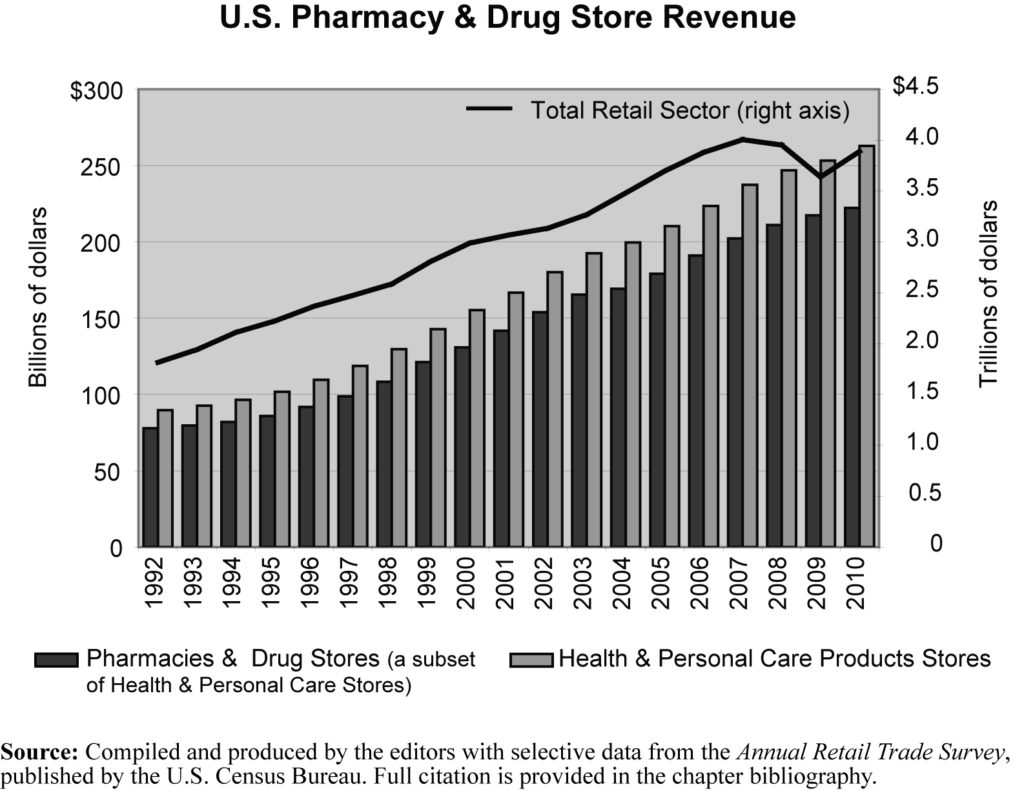

The retail pharmacy and drug store sector is defined by the U.S. Census Bureau as follows: “This industry comprises establishments known as pharmacies and drug stores engaged in retailing prescription or nonprescription drugs and medicines.” The companies in this category concentrate on selling prescription and over-the-counter drugs; many, however, sell a full line of other consumer products including items such as skin care products, cosmetics, toiletries, candy and tobacco products, household cleansers and other odds and ends one may find in a convenience store. The expansion of merchandise offerings in drug stores is one of the trends seen in this industry in recent decades. Worth noting is that the sales statistics provided in the graph above do not include the sales of general merchandising stores or grocery stores that may include a pharmacy department but for which the sale of drugs is not the primary business.

OVERVIEW

The story of drug stores over the last few decades is not unlike that of other retail industries, filled with chapters on the changing mix in merchandise offered, the rise of new competitors, and the decline of the independents—while the large chains grow and consolidate. For drug stores an important part of this story centers on the expansion of the prescription drug industry and changes within the distribution chain for those drugs.

U.S. drug stores have seen strong and steady growth over the last two decades. Sales through drug stores, shown on the graph above, grew at a rate of 186 percent between 1992 and 2010. This growth rate was higher than the growth rate seen for all retailing (114%) and higher than the rate of growth of the gross domestic product (GDP) as a whole (129%). The robust growth experienced in the retail pharmacy and drug store sector has been a factor in drawing other retailers into competition with drug stores. Many supermarkets, general merchandisers, and discount stores have established pharmacy departments that now compete with more traditional drug stores. Another significant competitor has been the online selling of pharmaceuticals—both prescription drugs and over-the-counter drugs. The number of retail outlets competing with traditional drug stores has grown sharply, and behind the growth in drug store sales is another story about tightening profit margins.

Drug stores sell a large range of products, from consumables and cosmetics to toiletries, tobacco, and photo finishing. The sale of drugs is only one part of a drug store’s business, but over the past two decades it has been a growing part. In 1995, the sale of prescription drugs accounted for approximately 58 percent of all pharmacy and drug store sales. In 2010, that percentage had risen to 68 percent but was, in fact, down from its peak of 77 percent in 2004. Passage of a new law at the end of 2003—the Medicare Prescription Drug, Improvement and Modernization Act—produced a significant increase in prescription drug sales during the middle of the decade starting in 2006. Drug stores have benefited from this influx of business created by a growing number of seniors with insurance policies that help them pay for prescription drugs.

Another change on the pharmaceutical landscape that occurred around this same time has also benefited pharmacies and drug stores in the later half of the decade 2000—2010. This change is the rise of generic drugs. While brand name drugs are more expensive than generic drugs for the consumer, generic drugs offer pharmacies a larger profit margin. Generic drugs began to rise as a percentage of all prescription drug sales in 2001. That year they represented 41 percent of prescription drugs sold through retail outlets. By 2010, generic drugs accounted for 71 percent of retail prescription drug sales, an encouraging trend for drug store operators.

A repeating theme within the retail sector is the decline of independent outlets and the rise of large chain operations and, further, the consolidation of those chains into larger and larger entities. This has been an ongoing pattern of activity in the sector for several decades. Between 1982 and 2007, according to data from the Census Bureau’s Economic Census series, the number of pharmacies and drug stores declined by 23 percent, from 52,000 to 40,000. While the overall number of establishments was declining, the large chain retailers were increasing their numbers and the numbers of independents were diminishing. The number of independents in 1990 was approximately 36,000 but by 2000 that number was down to approximately 20,000. Meanwhile, chain drug stores were busy growing through mergers, buyouts, and the opening of new stores. In 1997, the three largest drug store chains together operated 10,742 stores. By 2010, the top three were operating nearly twice that number of stores, 19,580 all together. They were consolidating their control on the market even as other retailing sector players—supermarkets, general merchandising outlets, and discount clubs—were entering the field and beginning to compete in the sale of prescription drugs. This pattern of increased concentration is clearly visible in the Market Shares Over Time section of this chapter.

CURRENT TRENDS

The industry is poised to see continued growth as the economy builds back after the recession and financial crisis of 2007—2009. U.S. demographics related to the aging of the population point towards continued high and growing levels of prescription drug use. Seniors are not, however, the only users of prescription drugs, and this is particularly true in the United States. There is, in fact, a trend towards using drugs to address a growing number of problems, a trend that has come to be known as the medicalization of society, a term that came from the title of a popular book on the subject published in 2007.

Efforts to control health care expenditures at the national and local levels are another factor that points towards a bright future for the retail pharmacy and drug store business, somewhat paradoxically. The paradox arises because the effort to rein in health care costs will likely include efforts to encourage the use of generic drugs rather that brand name drugs whenever possible. This will help to fuel the ongoing trend away from lower margin (for the retailer) brand name prescription drugs in favor of generic drugs for which the retail margins are slightly higher.

One variable in the drug pricing equation which is not as easy to forecast has to do with growing tensions among the various players in the complex distribution chain for prescription drugs, retail pharmacies and drug stores being just one of the players. The issue of third party payers came to a head at the end of 2011 when two of the industry’s leaders—Walgreens, on the side of retailers, and Express Scripts, on the side of third party payers—came to loggerheads and severed relations. Express Scripts is one of the nation’s largest third party payers in the prescription drug distribution channel. These companies, called Pharmacy Benefit Managers (PBMs), play an important role in managing prescription drug prices for insurance companies, large self-insured employers, and government benefit providers. They develop and maintain drug formularies—lists of specific drugs to be covered and the prices for each—for their insurance providing customers. They also negotiate with pharmaceutical companies for preferred pricing on the drugs covered in those formularies and they negotiate with retailers to accept those terms and participate in the PBM’s network of preferred pharmacies. Until the end of 2011, Walgreens was a part of the Express Scripts’ Preferred Pharmacy Network, but when negotiations broke down between the parties, Walgreens pulled out of that network.

In very practical terms this means that a person who has health insurance through WellPoint, one of the companies for which Express Scripts serves as its PBM, will no longer be able to purchase drugs from Walgreens at the preferred price negotiated for by Express Scripts. If the customer wishes to purchase his or her drugs from Walgreens nonetheless, he or she will have to pay a higher price. Conversely, WellPoint’s clients will no longer be offered the convenience of shopping at the nation’s largest drug store chain. How this situation evolves in 2012 will likely provide some indication about the direction in which the rising tensions between parties in the prescription drug supply chain will be resolved.

The trend seen in recent decades of consolidation in the industry is expected to continue, as are efforts on the part of drug stores to expand their offerings. The large chains are expanding their offerings through the inclusion, for example, of fresh fruits and vegetables by many Walgreens stores in urban areas. The expansion of clinics providing full service nursing personnel in stores run by CVS and Walgreens is another example of efforts to expand offerings related to health care generally. An industry rumor in late 2011 had Wal-Mart contemplating the purchase of Rite-Aid, the nation’s third-ranked drug store chain in that year. The one thing that may be said with some certainty about the future of the retail pharmacy and drug store sector is that it will look very different in coming years than it does today.

TIMELINE

- 1901 Charles R. Walgreen Sr., founder of the Walgreens chain, opens his first drug store in Chicago, Illinois.

- 1916 Nine drug stores incorporate as Walgreens Company.

- 1927 Walgreen Company stock goes public.

- 1961 Eckerd Corporation, a leading drug store chain that was originally founded in 1898, changes ownership structure from a proprietorship to a publicly owned company.

- 1962 Rite Aid opens its first discount drugstore in Scranton, Pennsylvania. The store, called the Thrif D Discount Center, is the forerunner of the Rite Aid drug store chain.

- 1963 The first CVS store is opened in Lowell, Massachusetts. The store sells health and beauty products and does not offer a pharmacy department.

- 1966 The first Rite Aid pharmacy opens in one of the company’s drugstores in New Rochelle, New York.

- 1967 CVS begins operating its first stores that include a pharmacy department at locations in Warwick and Cumberland, Rhode Island.

- 1975 Wal-Mart opens the first pharmacy in a Wal-Mart store, a department that will become a standard part of the general merchandise chain’s offerings.

- 1981 Walgreens begins to connect all of its pharmacies through a satellite network.

- 1992 Walgreens opens the first of its stores to include a drive through pharmacy.

- 1994 CVS launches PharmaCare, a pharmacy benefit management (PBM) company.

- 1996 Melville Corporation, the parent company of CVS, changes its name to CVS Corporation and begins to trade on the New York Stock Exchange with the symbol “CVS”.

- 1997 Walgreens completes the roll out of its proprietary computer network, Intercom Plus, across all of its stores. Intercom Plus is the leading pharmacy system in the industry.

CVS ProCare is established as a specialty pharmacy subsidiary of CVS. All ProCare stores are later rebranded as PharmaCare Stores in 2004. - 1999 Walgreens launches a comprehensive online pharmacy, located at Walgreens.com. The web-based service offers Walgreens’ customers a variety of services including online shopping, access to information about health and wellness from the Mayo Clinic, and a place to fill prescriptions.

- 2003 The Medicare Prescription Drug, Improvement and Modernization Act of 2003 is passed and signed into law. The new law creates the federal Voluntary Prescription Drug Benefit Program under “Part D” of the Social Security Act. Eligible Medicare beneficiaries are able to obtain prescription drug coverage under Part D by enrolling in a prescription drug plan (“PDP”) or a “Medicare Advantage” plan that offers prescription drug coverage.

- 2004 Starting in this year all new Target Stores include a pharmacy and in the next few years Target Corporation’s interest in the growing “wellness services” industry is seen in its opening of a chain of Target Clinics.

CVS buys the Eckerd chain of drug stores and PBM/Mail-order business that had been a part of J.C. Penny since the merger of Eckerd Corporation and J.C. Penny in 1996. - 2006 Walgreens begins offering in-store health clinics, called Health Corner Clinics, with nurse practitioners treating walk-in patients for common ailments.

Wal-Mart rolls out a new Affordable Prescription Drug Program in its 3,800 U.S. Wal-Mart and Sam’s Club stores nationwide. The program offers a $4 price for a 30-day supply of hundreds of different generic drugs and a $10 price for a 90-day supply. - 2007 Walgreens acquires Take Care Health Systems, a company that operates health clinics in seventeen states. With the acquisition Walgreens expands its growing network of clinics that it expects to number 400 by the end of 2008.

CVS acquires the large PBM, Caremark Rx, which was under hostile take over threat from Express Scripts, another leading PBM. The newly merged company is named CVS Caremark Corp. - 2011 Wal-Mart opens its first stand-alone pharmacy in Mexico City. The move is seen within the industry as a sign that Wal-Mart intends to compete more aggressively in the pharmacy and drug store sector. Until now the retail giant saw the ability to fill drug prescriptions in the store simply as an added convenience to support one stop shopping and its value message. However, the unveiling of this new standalone pharmacy shows us that Wal-Mart is looking to compete more aggressively on a whole new front.

- 2012 As of January first and due to an inability to reach agreement on a renewal of their contract, Walgreens is no longer part of the Express Scripts’ pharmacy provider network. The business that Walgreens did filling prescriptions for Express Scripts network clients in 2011 brought in an estimated 7% of its total revenue.