Catastrophe bonds, first issued in 1997, are a way for insurance companies to raise money to pay customer claims in the event of a catastrophic natural disaster. The insurance company issues bonds through an investment bank. The investment bank serves as a liaison between the insurance company and the investors, which are typically hedge funds, mutual funds, and pension funds. The investment bank invests the proceeds from the sale of the bonds and pays interest to the investors. It also dispenses the proceeds from the bond sales back to the issuer when a predefined disaster risk happens. The disaster risk could be the issuer’s actual losses, the issuer’s losses based on disaster parameters input into modeling software or the industry’s losses beyond a defined threshold. It can also be a specific condition linked to a natural disaster, such as an earthquake of magnitude 7.0 on the Richter scale.

Although investors risk losing their principal investment, some investors feel that the risk is worth it for the high yields and diversified portfolio of assets. Catastrophe bonds are not correlated with other financial markets. Since the financial crisis of 2008, and the collapse of Lehman Brothers, investment banks have been investing catastrophe bond collateral in Treasury money market funds, seen as safer than the investments in financial instruments made prior to the collapse.

Insurance and reinsurance companies make up 85% of the issuers of catastrophe bonds. The other 15% of issuers

Today’s market size shows the total value of catastrophe bonds in the United States as of the first half of 2018. From 2010 to 2017 the amount in outstanding catastrophe bonds doubled and despite the historically high losses due to Hurricanes Irma, Harvey, and Maria in the first half of 2018, the catastrophe market continued to grow. In the future, catastrophe bonds may cover more than losses from natural disasters. Insurance companies are currently developing better catastrophe bond modeling to cover losses due to cyber attacks and terrorism.

Geographic reference: United StatesYear: First half of 2018

Market size: $30 billion

Sources: Oliver Ralph, “Global Catastrophe Bond Market Size Climbs to a Record $30bn,” Financial Times, September 6, 2018 available online here; Andy Polacek, “Catastrophe Bonds: A Primer and Retrospective,” Chicago Fed Letter, No. 405, 2018 available online here; “Catastrophe Bond,” Wikipedia, December 10, 2018 available online here.

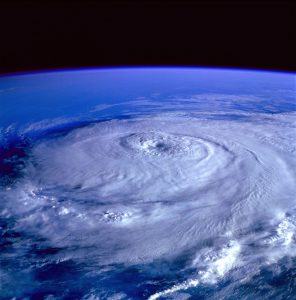

Image source: 12019, “hurricane-earth-satellite-tracking-92968,” Pixabay, March 13, 2013 available online here.