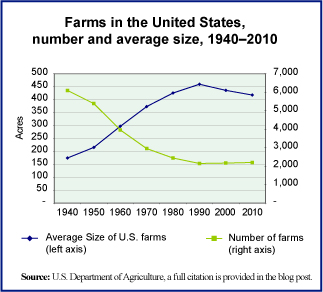

It takes far fewer acres to produce the food we need and in the United States the total number of acres used in agriculture have been shrinking for decades, while output has grown. The number of farms has also been shrinking as larger and more industrial-sized farms have come to dominate the market.

These trends in farming can be seen in the graph. It shows the number of farms and the average size of U.S. farms each decade since 1940. What we thought was of interest is the fact that there has been a small change in the century-long trend of growing average farm size. Since 1990, the average size of farms has actually shrunk, slightly, from 460 acres to 418 acres. There was also a slight increase in the number of farms between 2000 and 2010. The relatively small movement back to family or small-scale farming, and in particular organic farming, is large enough to be visible in the national statistics and on the size of the average farm in the United States.

Today’s market size is the total number of farms in the United States in 1990 and 2010 as well as the total value of farm output in those two years.

Geographic reference: United States

Year: 1990 and 2010

Market size: 1990: 2,146 farms with output valued at $180 billion

Market size: 2010: 2,201 farms with output valued at $300 billion

Sources: (1) “Table 824. Farms—Number and Acreage: 1990 to 2010,” Statistical Abstract of the United States: 2012, U.S. Census Bureau, December 2011, page 536, available online here. (2) “Table 1101. Farms—Number and Acreage: 1959 to 1989,” Statistical Abstract of the United States: 1990, U.S. Census Bureau, January 1990, page 638. (3) “Series K 1-16. Farm Populations, Land in Farms, and Value of Farm Property and Real Estate: 1850 to 1970,” Statistical Abstract of the United States: Colonial Times to 1970, U.S. Census Bureau, September 1975, page 457.

Original source: U.S. Department of Commerce, Bureau of the Census

Posted on January 10, 2014