Year: 2019 and 2027

Market size: $104.5 billion and $231.2 billion, respectively

Today’s market size shows total global revenues for medical device outsourcing. Think about “outsourcing” and you might think “manufacturing,” especially if you live in the United States.1 In this case, you would be mostly correct. Contract manufacturing claimed 55.8% of the market in 2019. What other aspects of the business do medical device firms outsource? A quarter of the revenue came from a combination of quality assurance services, product design and development services, and product testing and sterilization services. Revenue from regulatory affairs services, product implementation services, product upgrade services, and product maintenance services rounded out the rest of the market. More than 300 medical device contract research organizations offer services such as clinical trial monitoring, clinical data management, initiation of clinical trials, medical writing, formulation of clinical strategies, and clinical product management.

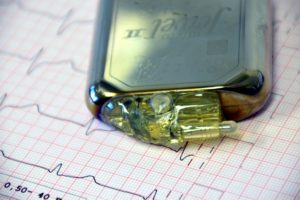

Chronic diseases are on the rise across the world. Since 1990, rates of diabetes climbed 148%, chronic kidney disease 93%, ischemic heart disease 50%, and COPD 26%. As chronic disease rates rise, demand for medical devices also rises. The cardiology segment had the highest revenue share in 2019 and is expected to be the fastest-growing segment through 2027. In vitro diagnostic device (IVD) segment revenues are also expected to experience significant growth over this time period. IVDs are defined as “reagents, instruments, and systems intended for use in [the] diagnosis of disease[s] or other conditions, including a determination of the state of health, in order to cure, mitigate, treat, or prevent disease or its sequelae. Such products are intended for use in the collection, preparation, and examination of specimens taken from the human body,” according to the U.S. Food and Drug Administration.

The Asia-Pacific region had the highest revenue share for medical device outsourcing in 2019 and is expected to continue to hold the highest share through 2027 due to increasing research and development, adoption of new technology, availability of a skilled workforce, and lower cost of devices. North America also had a significant share of the market owing to its advanced electronics sector. Some leading companies providing outsourcing services to medical device firms include SGS SA, Toxikon Inc., Eurofins Scientific, Pace Analytical Services LLC, Intertek Group PLC, Wuxi Apptec, North American Science Associates Inc., Tüv Süd AG, American Preclinical Services, Sterigenics International LLC, and Charles River Laboratories International Inc.

1 In the United States, manufacturing jobs averaged a high of 19,428,000 in 1979 and fell to a low of 11,529,000 in 2010, a loss of more than 7.8 million jobs. While not all of these job losses were due to outsourcing—some were due to automation—the focus of the discussion around this issue has been on companies closing plants in the United States and opening them across the border in Mexico and overseas in the Asia-Pacific region. By 2019 manufacturing employment rebounded slightly to 12.8 million. For more information about the manufacturing sector as a whole and individual NAICS industries in the United States, see Manufacturing & Distribution USA, 9th Edition.Sources: “Medical Device Outsourcing Market Size Worth $231.2 Billion by 2027,” Grand View Research Press Release, February 2020 available online here; “Medical Device Outsourcing Market Size, Share & Trends Analysis Report by Service (Quality Assurance, Regulatory Affairs Services), by Application (Cardiology, Diagnostic Imaging, Orthopedic), by Region, and Segment Forecasts, 2020 – 2027,” Grand View Research Report Summary, February 2020 available online here; “Manufacturing: NAICS 31-33,” Industries at a Glance, U.S. Bureau of Labor Statistics available online here; Mary Van Beusekorn, “Global Study Shows Deadly Convergence of Chronic Disease, COVID-19,” Center for Infectious Disease Research and Policy, University of Minnesota, October 16, 2020 available online here; “Overview of IVD Regulation,” U.S. Food and Drug Administration, September 16, 2019 available online here; “Global Burden of 369 Diseases and Injuries in 204 Countries and Territories, 1990-2019: A Systematic Analysis for the Global Burden of Disease Study 2019,” Global Health Metrics, October 17, 2020 available online here; “The Medical Device CRO Market is Projected to Reach USD 15.7 Billion by 2030, Growing at an Annualized Rate of 6.4%, Claims Roots Analysis,” CISION PR Newswire, June 23, 2020 available online here.

Image source: Ulrike Leone, “pacemaker-cardiac-pacemaker-1943662,” Pixabay, January 3, 2017 available online here.

The market for smart wearable healthcare devices is one part of the larger smart wearables market as a whole. The term wearables is used to refer to any electronic device, usually small, that can be worn relatively easily during the normal activities of life. Examples include wristbands such as the Fitbit, smart watches, clip on devices like pedometers and even clothing into which sensors have been sewn.

The market for smart wearable healthcare devices is one part of the larger smart wearables market as a whole. The term wearables is used to refer to any electronic device, usually small, that can be worn relatively easily during the normal activities of life. Examples include wristbands such as the Fitbit, smart watches, clip on devices like pedometers and even clothing into which sensors have been sewn.