Year: 2018 and 2025

Market size: $102.2 billion and $557.9 billion, respectively

Today’s market size shows total global revenues for dropshipping services in 2018 and projected for 2025. Dropshipping is a retail fulfillment service; however, the retailer does not keep a stock of inventory. The retailer transfers the customer order to the manufacturer or wholesaler who then ships the items to the customer directly on behalf of the retailer. The retailer charges the customer for the items and the manufacturer or wholesaler charges the retailer for the items. As with any retail transaction, each party marks up the price of the item to make a profit.

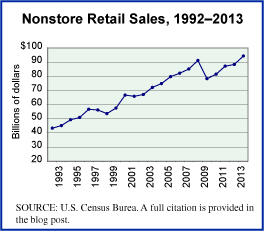

The growth in dropshipping services is fueled by the growth in online shopping. From 2016 to 2020, worldwide e-commerce sales grew from $1.8 trillion to $4.3 trillion. The proliferation of smartphones has pushed mobile commerce sales from $0.97 trillion to $2.91 trillion over this same time period, with a 22.3% jump in sales predicted for 2021.

Dropshipping has many advantages for aspiring entrepreneurs: the ability to test different business ideas and learn how to choose and market products, less capital investment, low overhead, flexible location, and easier scaling of the business. But, dropshipping also has many drawbacks. Because a retailer will have competing stores selling similar or identical products at low prices, profit margins most of the time will be low. Inventory issues may also arise as inventory can change daily and be out of the retailer’s control if it deals with a supplier or multiple suppliers that are also working with other clients. If a retailer does work with multiple suppliers, calculating shipping prices on orders can be complex. And, if something goes wrong with the fulfillment of an order, the retailer may have to take the blame, apologize, and refund the customer’s money even if the problem lies solely with the supplier. As a consequence, a retailer’s business reputation may be damaged through no fault of its own. After weighing the pros and cons, 27% of online retailers have decided to use dropshipping as of 2021.

By product, electronics garnered the largest revenue share in 2018. The food and personal care segment is projected to grow at a 30% compound annual growth rate through 2025 as consumers increasingly buy skincare products, perfumes, cosmetics, and personal care products online. The fashion segment is also projected to have significant growth over this time period. The popularity of branded products and the ability to shop for several brands on a single platform will drive growth in this area. In addition, the luxury furniture segment is expected to experience considerable growth through 2025.

The Asia-Pacific region claimed a 25% revenue share in 2018. An increasing number of e-commerce companies in the region is driving demand for dropshipping services. A rise in the number of e-commerce startups in India, for example, will fuel demand for dropshipping services as these services allow startups, especially those with limited resources, to focus on marketing to compete better with larger, more established retailers. North America is expected to experience considerable growth through 2025 as mobile commerce and voice-enabled virtual assistant purchases become more common. Easy ordering and returning will also spur e-commerce sales which will, in turn, create demand for dropshipping.

The dropshipping market contains many small and medium-sized firms, with a few large global companies. These include AliDropship, Doba Inc., SaleHoo Group Ltd., and Oberlo. In 2017, Shopify Inc., an e-commerce platform, acquired Oberlo to improve its market share. Several other major e-commerce companies have expanded their services to offer dropshipping to manufacturers and wholesalers.

Sources: “Dropshipping Market Size, Share & Trends Analysis Report by Product (Toys, Hobby & DIY, Furniture & Appliances, Food & Personal Care, Electronics & Media, Fashion), by Region, and Segment Forecasts, 2019 – 2025,” Grand View Research Report Summary, December 2019 available online here; “Dropshipping Market Size Worth $557.9 Billion by 2025 | CAGR: 28.8%: Grand View Research, Inc.,” CISION PR Newswire, January 20, 2020 available online here; “Mobile Commerce Sales in 2021,” Oberlo available online here; Tugba Sabanoglu, “Retail E-commerce Sales Worldwide from 2014 to 2024,” Statista, March 26, 2021 available online here; Corey Ferreira, “What is Dropshipping?” Shopify Blog, January 1, 2021 available online here; Olusola David, “20+ Dropshipping Statistics & Facts 2021 [Full Analysis Report],” Torchbankz, January 4, 2021 available online here.Image source: rupixen, “payment-online-payment-card-payment-4334491,” Pixabay, July 13, 2019 available online here.

As a percentage of total retail sales in the country, Pakistan’s e-commerce market is quite small, 0.34%, but is expected to grow as adoption of technology becomes more widespread. As of January 2018, there were 52 million subscribers to broadband internet, up from 44.5 million a year before. The number of online payment merchants increased nearly 60% during this time period, from 571 to 905. Banks are starting to allow debit and credit cards to be used for online purchases. However, fewer people have bank accounts than have broadband internet. And, fewer still—21.1 million— have either a debit or a credit card. Currently, 4 out of 5 online orders are cash on delivery. Several online payment gateways allow nearly every Pakistani to pay for their online purchases with cash.

As a percentage of total retail sales in the country, Pakistan’s e-commerce market is quite small, 0.34%, but is expected to grow as adoption of technology becomes more widespread. As of January 2018, there were 52 million subscribers to broadband internet, up from 44.5 million a year before. The number of online payment merchants increased nearly 60% during this time period, from 571 to 905. Banks are starting to allow debit and credit cards to be used for online purchases. However, fewer people have bank accounts than have broadband internet. And, fewer still—21.1 million— have either a debit or a credit card. Currently, 4 out of 5 online orders are cash on delivery. Several online payment gateways allow nearly every Pakistani to pay for their online purchases with cash.  Sales in India’s overall retail sector totaled Rs 49 trillion during the 2017 fiscal year.1 Small to medium-sized independent businesses and mom-and-pop type stores make up the greatest share of this market, with chain stores, franchises, and large stand-alone stores making up a mere 7%. The e-commerce sector has an even smaller share, 1.5%, despite its share tripling in the three years prior. Currently, three-quarters of total e-commerce sales come from major cities in India.

Sales in India’s overall retail sector totaled Rs 49 trillion during the 2017 fiscal year.1 Small to medium-sized independent businesses and mom-and-pop type stores make up the greatest share of this market, with chain stores, franchises, and large stand-alone stores making up a mere 7%. The e-commerce sector has an even smaller share, 1.5%, despite its share tripling in the three years prior. Currently, three-quarters of total e-commerce sales come from major cities in India. For many years people have been buying books, clothing, and housewares online. Why not groceries? The grocery industry in the United States generates more than $600 billion in sales. Nearly everyone shops for groceries and an overwhelming majority shop for groceries at least once a week. Online grocery-shopping services offer the consumer convenience, but many times this convenience comes at a price. Because the consumer is paying someone else to shop for them, in order to pay these employees companies may charge higher prices for the groceries themselves and charge for shipping or delivery. Also, the consumer has to trust that the online grocery-shopping service employees will select the best produce, meat, and other perishable items and deliver them to their door in a timely manner and in good condition.

For many years people have been buying books, clothing, and housewares online. Why not groceries? The grocery industry in the United States generates more than $600 billion in sales. Nearly everyone shops for groceries and an overwhelming majority shop for groceries at least once a week. Online grocery-shopping services offer the consumer convenience, but many times this convenience comes at a price. Because the consumer is paying someone else to shop for them, in order to pay these employees companies may charge higher prices for the groceries themselves and charge for shipping or delivery. Also, the consumer has to trust that the online grocery-shopping service employees will select the best produce, meat, and other perishable items and deliver them to their door in a timely manner and in good condition. The World Wide Web. A decentralized network of data stored on servers all around the world. But many countries—China, Russia, Germany, and Belgium, to name a few—are enacting laws requiring multinational companies to store and process country-specific data on local servers. According to the source, relaxing such restrictions has become a priority of President Donald Trump’s administration as they negotiate trade agreements, including the upcoming renegotiation of NAFTA.

The World Wide Web. A decentralized network of data stored on servers all around the world. But many countries—China, Russia, Germany, and Belgium, to name a few—are enacting laws requiring multinational companies to store and process country-specific data on local servers. According to the source, relaxing such restrictions has become a priority of President Donald Trump’s administration as they negotiate trade agreements, including the upcoming renegotiation of NAFTA.