Year: 2013, 2016, and 2019

Market size: $870 million, $1.08 billion, and $1.21 billion, respectively

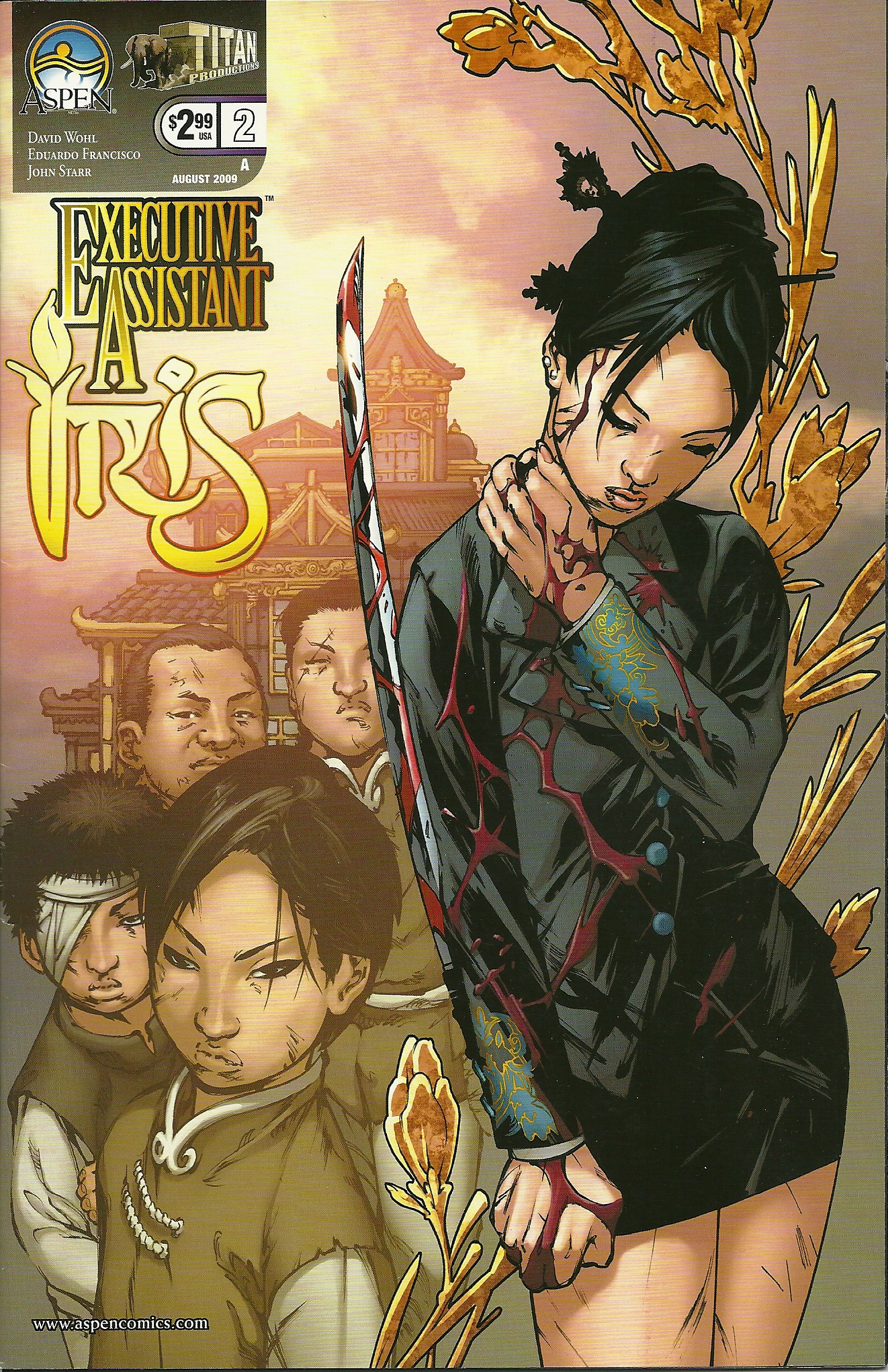

Since 2002, Free Comic Book Day has been held on the first Saturday of May, however, due to COVID-19, the celebration has been moved to August 14th this year. On this day, comic book publishers, both majors and independents, make available for free specially-printed comic books at thousands of local comic shops across North America and the world. Free Comic Book Day was “founded on the belief that for every person out there, there’s a comic book they’ll love.”1

Today’s market size shows total North American revenues for comic books and graphic novels in 2013, 2016, and 2019. From 2013 to 2019 sales trended upward, rising 39.1%. However, not all years saw sales increases. Sales decreased by 6.5% from 2016 to 2017 before rising above 2016 levels in 2018.

Graphic novels constituted most sales, $765 million or a 63.2% share in 2019. Since at least 2014 graphic novels have grown their share of the market. Comic book sales have been dropping since 2016 while digital comic sales have remained steady throughout this time period.

In 2019 for the first time, graphic novels sold in the book channel outpaced sales of graphic novels in the comic book store channel. The book channel includes chain bookstores, mass merchandisers, major online retailers, and Scholastic book fairs. Sales of children’s graphic novels drove the market.

Sales of comic books and graphic novels in the book channel claimed 47.1% of the market, comic book stores 43.4%, digital downloads 7.4%, and other channels 2.1% in 2019. Newsstand sales and crowdfunding claimed nearly half of sales in the “other” category. Top comic book publishers by unit share included Marvel Comics (44.72%), DC (30.74%), Image Comics (7.69%), IDW Publishing (3.29%), Boom! Studios (2.42%), Dark Horse Comics (2.33%), Dynamite Entertainment (1.88%), Viz Media (0.55%), Titan Comics (0.49%), and Oni Press (0.43%). Other publishers claimed 5.47% of the market. The top-selling comic book in 2019 was Detective Comics #1000 and the top-selling graphic novel was Watchmen TP.1 Source: “What is Free Comic Book Day?” Diamond Pop-Culture Network, November 8, 2018 available online here.

Sources: Heidi MacDonald, “Comics and Graphic Novel Sales Top 1.21B in 2019 — The Biggest Year Ever,” The Beat, July 15, 2020 available online here; “What is Free Comic Book Day?” Diamond Pop-Culture Network, November 8, 2018 available online here; Heidi MacDonald, “Comics/GN Sales Up 2.23% in 2019 as Watchmen and Detective Top the Charts,” The Beat, January 10, 2020 available online here;

Image source: tunechick83, “batman-comic-con-comics-books-2216148,” Pixabay, April 11, 2017 available online here.