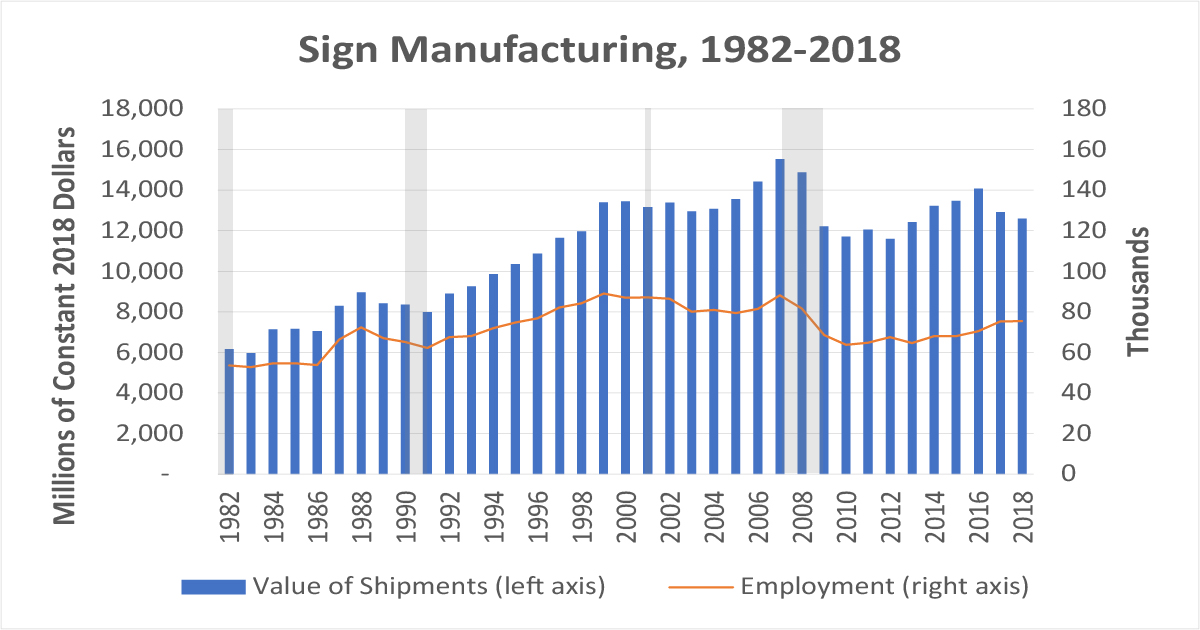

Year: 1982, 1992, 2002. 2012. 2018

Market size (billions of real dollars): $2.7, $5.4, $9.8, $10.5, and $12.6, respectively

Market size (billions of constant 2018 dollars): $6.2, $8.9, $13.4, $11.6, and $12.6, respectively

Whether hand-written, laser-printed, neon or digital, signs are everywhere. Stop signs, street signs, point-of-purchase displays, signs above retail establishments, signs in restaurants displaying their menus, digital advertisements. Most people take these for granted, but sign manufacturing in the United States is a multi-billion dollar industry employing more than 75,000 people at 5,853 establishments around the country. Today’s market size shows sign manufacturing’s value of shipments for 1982, 1992, 2002, 2012, and 2018 in both real dollars and constant 2018 dollars. The graph shows more thorough views of the value of shipments in constant dollars and employment from 1982 to 2018. The gray boxes in the graph show recessionary periods.

Although sign manufacturing shipment values rose and fell several times throughout this time period, they trended upward from 1982 to 2007, reaching a high of $15.5 billion,1 before the advent of the Great Recession. By the end of the Great Recession, the value of shipments fell to 1998 levels. Since then, again, values have risen and fallen, however, the peak in 2016 fell short of the 2007 peak value. Since 2016, values have trended downward. In 2020, with manufacturing operations temporarily suspended and consumer demand for signs down due to the lockdowns in response to the COVID-19 pandemic, shipment values are expected to continue the downward trend. However, not all types of signage will see a drop. There has been increased demand for medical equipment displays for ventilators and respirators and signage for retail establishments detailing social distancing guidelines and safety practices.

Worldwide in 2018, the printed signage market totaled $45.73 billion while the digital signage market reached $18.55 billion. Printed signage is the most widely used due to its lower cost and longer lifespan without additional maintenance costs. It’s mostly used for advertisement and marketing purposes to attract customers or to showcase a product. Globally, printed signage revenues are expected to grow at a compound annual growth rate (CAGR) of 0.31% through 2025, however, in North America, revenues are expected to contract by a CAGR of -0.68% as demand for more dynamic and customized advertising has led to a decrease in printed signage demand and an increase in demand for digital solutions. As a result of this downturn, major companies are focusing their efforts on expanding their customer base outside the region. Leading printed signage companies in North America include Avery Dennison Corp., Sabre Digital Creative, Print Source Signs & Display, James Printing & Signs, Kelly Signs Inc., Chandler Inc., RGLA Solutions Inc., Accel Group Inc., AJ Printing and Graphics, Southwest Printing Co. and Vistaprint.

Digital signage revenues are expected to grow by a CAGR of 8.0% globally through 2025, and 6.4% in the United States through 2027.2 Demand for biometric technology3 and digitized information management that can be accessed from a remote location are leading to greater adoption of digital signage. In the United States increasing adoption of touch-based and gesture-based displays will lead to a significant boost to the market. Also, many advertisers prefer digital display advertising over conventional marketing for its ability to include eye-catching pictures and motion.

Video walls garnered the highest market share globally as well as in the United States due to their ease of installation, mounting, and connectivity. In-store displays4 had a higher market share than out-store displays, but out-store displays are expected to experience the highest growth over the next few years as more digital displays are installed in transportation venues such as bus stands, train stations, railway stations, airports, and inside taxi cabs, buses, trains, and subway cars in order to show promotional as well as informational content. Digital signage demand at concert and other entertainment venues will see a drop in 2020 while they remain closed during the COVID-19 pandemic, however, interest is expected to increase in 2021 and beyond as more sites open to patrons again.

Worldwide, vertically-oriented content—safety signs and information, corporate communication, sales dashboards, direction and transportation information—had a market share of more than 50% in 2018. Health and wellness and news also accounted for significant market share and these two categories are expected to grow substantially in the coming years due to higher demand in the healthcare and corporate sectors. In the U.S., the retail sector topped market share as leading adopters of the technology, but there is also tremendous growth potential in this sector. Revenues for digital signage in the healthcare sector are expected to grow substantially in the United States through 2027. Digital signage in healthcare is used to manage inventory and staff, notify staff and visitors, and display patient-related information. Leading digital signage manufacturers in the United States include NEC Display Solutions of America Inc., BrightSign LLC, Planar System Inc., Cisco Systems Inc., Intel Corp., Microsoft Corp., Keywest Technology Inc., Scala Inc., Visix Inc., Panasonic Corp. of North America, and Hughes Network Systems LLC. Worldwide, companies are focusing on innovation to increase revenues. Intel Corp. introduced the Open Pluggable Specification that is helping to standardize the design of digital marketing and Nippon Telegraph and Telephone Corp. has developed digital signs that use aroma-emitting devices.

1 Real dollar value: $13.0 billion.

2 All compound annual growth rates reported were calculated before the COVID-19 pandemic response slowed or halted production and demand.

3 Biometric technology includes gaze tracking software that can record how many people look at an ad, even in a crowded area.

4 In-store displays include all displays deployed within buildings, not just in retail locations.

Sources: Annual Survey of Manufactures, U.S. Census Bureau, various years available online here; Economic Census, U.S. Census Bureau, various years available online here; County Business Patterns, U.S. Census Bureau, June 25, 2020 available online here; Dan Barufaldi and Jim Chappelow, “A Review of Past Recessions,” Investopedia, June 8, 2020 available online here; “Five Jobs and Industries That Are Thriving Amid The COVID-19 Pandemic (and Why),” The Marlin Company, June 4, 2020 available online here; “Printed Signage Market – Growth, Trends, and Forecast (2019-2024),” 360 Market Updates, June 1, 2019 available online here; “North America Printed Signage Market – Growth, Trends, and Forecast (2019 – 2024),” Research and Markets Report Description, February 2019 available online here; “Printed Signage Market – Growth, Trends, and Forecast (2020-2025),” Mordor Intelligence About This Report available online here; “Digital Signage Market Size Analysis Report by Type, by Component, by Technology (LCD, LED, Projection), by Application, by Location, by Content Category, by Size, by Region, and Segment Forecasts, 2019 – 2025,” Grand View Research Report Summary, May 2019 available online here; “U.S. Digital Signage Market Size, Share & Trends Analysis Report by Component, by Hardware Components, by Display Type, by Display Technology, by Application, by Location, by Region, and Segment Forecasts, 2020 – 2027,” Grand View Research Report Summary, February 2020 available online here; Nina Goetzen, “Entertainment Digital Ad Spend Will Drop 6.9% This Year, But Gaming and SVOD Growth Will Offset Losses,” Business Insider, September 10, 2020 available online here.

Image source: Created in-house by The Editors from Annual Survey of Manufactures and Economic Census data.

According to Jim Louderback, CEO of VidCon, an annual online video conference held in Southern California, “[t]he younger you are the more likely you are to want to consume information in video form. If you’re under the age of 35, video is the way you want to be communicated with, it’s the way you want to learn and understand.” Knowing this, 56% of businesses surveyed by mobile video platform Magisto said they produce video content at least once a week, with 26% producing content daily. However, among companies that spend more than 25% of their marketing budget on video, those companies whose marketing departments are run by Millennials are less likely than those run by Generation Xers to spend money on business videos and less likely to create business video content on a daily basis.

According to Jim Louderback, CEO of VidCon, an annual online video conference held in Southern California, “[t]he younger you are the more likely you are to want to consume information in video form. If you’re under the age of 35, video is the way you want to be communicated with, it’s the way you want to learn and understand.” Knowing this, 56% of businesses surveyed by mobile video platform Magisto said they produce video content at least once a week, with 26% producing content daily. However, among companies that spend more than 25% of their marketing budget on video, those companies whose marketing departments are run by Millennials are less likely than those run by Generation Xers to spend money on business videos and less likely to create business video content on a daily basis.